You might ask, “What is a Business Team?” A Business Team is the core group of professionals to whom every business must have access. It includes…

Small business owners wear many hats – making it hard to get everything done. Even though fraud is big business for those who prey on small companies, taking steps to minimize the possibility is low on the to do list and many have no prevention tools available. Segregation of duties is a major deterrent, but it’s difficult with little or no staff. Rely on your professional partners to become part of your team. You work too hard to be taken advantage of!

With all the discussion about the Health Care laws that are being monitored by the IRS, just what are the tax implications for the 2013 tax year? Following are three key changes you should know about the Affordable Care Act (ACA) as it relates to your individual income tax return. 1.) increase in the “medical expense deduction floor”, 2.) additional 0.09 percent Medicare tax for “high income” taxpayers, 3.) 3.8 percent Medicare surtax on Net Investment income for “high income” taxpayers.

The House Judiciary Committee released basic principles pertaining to the issue of Internet sales tax. To develop these principles, the Committee received input directly from taxpayers, industry and trade groups, and representatives of…

Even though we are in the world of cordless mice and touchscreens – the keyboard is still very efficient. We all admit we like a few extra minutes to do something else besides our QuickBooks work. Check out these shortcuts to see if they will save you some time!

When families become employers, they take on many of the same responsibilities that business employers do – although many of the forms, deadlines and labor laws for household employers are unique.

From farmers to educators, the cloud environment is allowing many industries ways to utilize tools and expand their boundaries like never before. Whether it is utilizing apps and data or having their whole system in the cloud – the options are endless.

Federal income tax credits are designed to fill the gap between Medicaid and people who can afford to buy their own individual insurance or who belong to affordable health plans through their jobs. Use the calculator to determine if you could potentially get a credit.

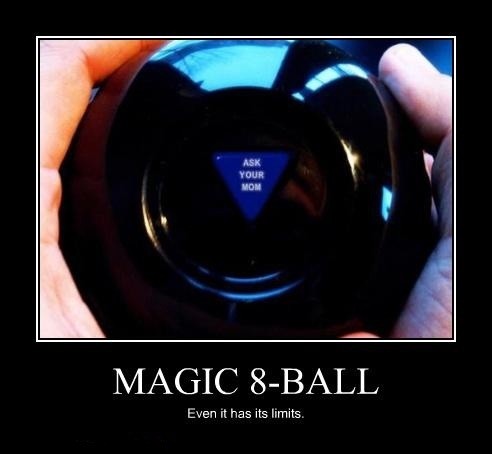

Planning for taxes takes more than a magic eight ball! While there is always a certain amount of inherent uncertainty in any planning, the goal is to provide enough information to have insight to how today’s decisions might change tomorrow’s outcomes. Luck comes to those best prepared. Choose to be prepared.

You probably know that non-exempt employees are covered under FLSA, which imposes requirements for overtime and other aspects of employment. Exempt employees, on the other hand, are not subject to FLSA.